Kristen and I made decent money and we're with ya.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tax Season 2016

- Thread starter reckedracing

- Start date

- Replies 67

- Views 7K

We may earn a small commission from affiliate links and paid advertisements. Terms

The federal poverty level is 11,770 plus 4160 for each additional person in the household.

So for a family of 3 you have to make less than 20,090 to be considered living in poverty for example.

You may be eligible for credits against your healthcare if you make up to 400% of the federal poverty level for your family size, which would be 80,360 for a family of 3.

So for a family of 3 you have to make less than 20,090 to be considered living in poverty for example.

You may be eligible for credits against your healthcare if you make up to 400% of the federal poverty level for your family size, which would be 80,360 for a family of 3.

definitely not making only 80K lol

i'd rather have that money maximized in my paycheck instead.

Liking it and having it be the smart thing are not one in the same.

Sure, it's nice to get a lump sum. but it's not the smartest thing to do for someone who has debt (can go towads the monthyl payments on anything- credit cards, house, car, etc)

for someone who has NO debt (rents/owns outright, no car payments, no CC), the savings interest on it isn't much. what's .05% on a grand or two? lol leaving it with uncle sam isn't a bad thing i guess in that sense. Although, in theory, it's more money.

Didn't you want the annuity on powerball take the extra monthly, invest/save it yourself and hit that account only once a year (your own 'christmas club account')

take the extra monthly, invest/save it yourself and hit that account only once a year (your own 'christmas club account')

It it's sizable, it's like funding a yearly roth/etc on jan 1 instead of through out the year. you get 364 more days for it to vest/work for you than if you wait until 12/31.

foil hat:

some day, uncle sam may say.. sorry, we can't afford to give refunds this year.

And you'll be screwed.

The ones who didn't give it to him to hold won't lose out.

I'm trying to get my refund down (first world problems lol). I went from 0 to 2 last year after taxes (so, a May hit to the payroll). and then i changed my 401k contribution (up 2%), and then i got a raise in october... I made like 2k more last year, but have a lower AGI because of the HSA and more 401k pre tax benefits. This year i'll make like 6k more than 2014 so my agi will go up a bit. I was going to try 3 but i don't know what a full year looks like so i'm scared to go to 3. lol Don't want to owe.

Sure, it's nice to get a lump sum. but it's not the smartest thing to do for someone who has debt (can go towads the monthyl payments on anything- credit cards, house, car, etc)

for someone who has NO debt (rents/owns outright, no car payments, no CC), the savings interest on it isn't much. what's .05% on a grand or two? lol leaving it with uncle sam isn't a bad thing i guess in that sense. Although, in theory, it's more money.

Didn't you want the annuity on powerball

It it's sizable, it's like funding a yearly roth/etc on jan 1 instead of through out the year. you get 364 more days for it to vest/work for you than if you wait until 12/31.

foil hat:

some day, uncle sam may say.. sorry, we can't afford to give refunds this year.

And you'll be screwed.

The ones who didn't give it to him to hold won't lose out.

I'm trying to get my refund down (first world problems lol). I went from 0 to 2 last year after taxes (so, a May hit to the payroll). and then i changed my 401k contribution (up 2%), and then i got a raise in october... I made like 2k more last year, but have a lower AGI because of the HSA and more 401k pre tax benefits. This year i'll make like 6k more than 2014 so my agi will go up a bit. I was going to try 3 but i don't know what a full year looks like so i'm scared to go to 3. lol Don't want to owe.

foil hat:

some day, uncle sam may say.. sorry, we can't afford to give refunds this year.

And you'll be screwed.

The ones who didn't give it to him to hold won't lose out.

you're assuming that if the gubment was so bold as to withhold tax refunds that they owed, that they wouldn't be equally as bold to send you a bill saying "whoops we didn't take enough"

E-filed my taxes 1/21. got my MD state refund today, still waiting on Fed (~$2000)

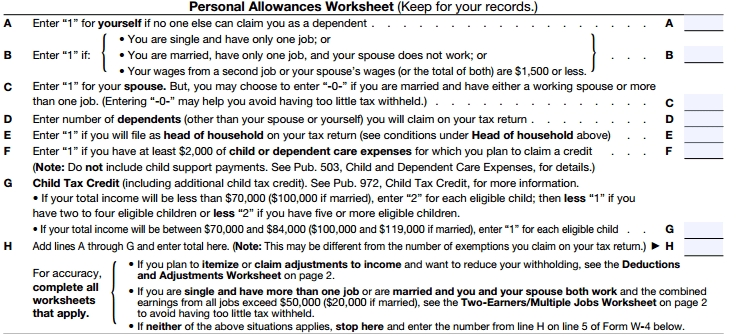

Maybe that's why I didn't get much of a refund. I claimed 2 on my new w-2 with F5. The w-4 is such a shitty form for claiming deductions. Nobody in HR knows how to fill them out.

I dont' see how you can claim zero. I claim 2. 1 because nobody claims me as a dependent and 1 because I'm single with just one job.

I dont' see how you can claim zero. I claim 2. 1 because nobody claims me as a dependent and 1 because I'm single with just one job.

When clients call i tell them to just skip the worksheet all together and provide them with the answers for boxes 3 and 5.

Then they will try and go back to the worksheet and ... but this says such and such... NO skip the worksheet, here's all you need to know.

Married 3, or Single 1 etc.

Then they will try and go back to the worksheet and ... but this says such and such... NO skip the worksheet, here's all you need to know.

Married 3, or Single 1 etc.

When clients call i tell them to just skip the worksheet all together and provide them with the answers for boxes 3 and 5.

Then they will try and go back to the worksheet and ... but this says such and such... NO skip the worksheet, here's all you need to know.

Married 3, or Single 1 etc.

I have a question about my w-4 now. what's the easiest way to contact you? I'd like to show you my w-2 and see if it makes sense to stay at 2.

Quick question...so my wife makes a lot less than me and only works part time, so our income gap is huge. I had her claim 0, but it looks like her payroll department doesn't withhold enough federal taxes because they don't know about my income putting us in a higher bracket.

Is there a form or something we can fill out that we could give to her payroll department to have them withhold a higher amount? Our refund dropped about $1,600 when I entered her W2 information into TurboTax.

Is there a form or something we can fill out that we could give to her payroll department to have them withhold a higher amount? Our refund dropped about $1,600 when I entered her W2 information into TurboTax.

Maybe I just solved my own question...I just looked at my W4 information online and I see that after your allowances you can specify an additional amount that you'd like taken out of your paycheck. I'm guessing that's where I need to allocate additional funds. Next question then...knowing how much our refund dropped, is that the target amount I should shoot for when deciding how much to take from each paycheck depending on how many paychecks she gets a year?

For example if the number is $1,600 and she gets paid 12 times a year, I'd want an additional $133 taken out of each paycheck?

For example if the number is $1,600 and she gets paid 12 times a year, I'd want an additional $133 taken out of each paycheck?

Starting to get pissed at the tax system. 33% marginal tax rate (estimate, haven't filed yet). Both my wife and I max out our 401k, I claim 2 mortgage interests (home and vacation club), student loan interest. I have 2 kids, 1 in elementary school, 1 in daycare (which I spent 12k on last year). Getting back about a K. Not sure what else I can do to lower my tax risks. We file as single & 0. I look forward to the chunk of change as it supports my Bob Vila habits for the year haha.

Yes, that is the basic idea. That assumes that her income will remain the same through out 2016. If her income starts going up or down your equation changes and you may not have the desired results.Maybe I just solved my own question...I just looked at my W4 information online and I see that after your allowances you can specify an additional amount that you'd like taken out of your paycheck. I'm guessing that's where I need to allocate additional funds. Next question then...knowing how much our refund dropped, is that the target amount I should shoot for when deciding how much to take from each paycheck depending on how many paychecks she gets a year?

For example if the number is $1,600 and she gets paid 12 times a year, I'd want an additional $133 taken out of each paycheck?

We run into this with married couples that have different income levels, = different withholding rates on payroll. People who have multiple W-2's also run into this problem as each employer only withholds based on the expected yearly wages for that one company. So lets say 10 w-2's at 10k each, all in the 10% bracket, but year end they have 100k and wind up in the 25% or higher bracket depending on deductions etc. That's always a shock.

Yes, that is the basic idea. That assumes that her income will remain the same through out 2016. If her income starts going up or down your equation changes and you may not have the desired results.

We run into this with married couples that have different income levels, = different withholding rates on payroll. People who have multiple W-2's also run into this problem as each employer only withholds based on the expected yearly wages for that one company. So lets say 10 w-2's at 10k each, all in the 10% bracket, but year end they have 100k and wind up in the 25% or higher bracket depending on deductions etc. That's always a shock.

Sounds good. Forgot to think about if she gets a significant pay increase or works additional hours. Thanks for the info.

I assume that your separate incomes are in a lower bracket than the combined marginal rate for filing together, so that is why you are getting slammed when you file.Starting to get pissed at the tax system. 33% marginal tax rate (estimate, haven't filed yet). Both my wife and I max out our 401k, I claim 2 mortgage interests (home and vacation club), student loan interest. I have 2 kids, 1 in elementary school, 1 in daycare (which I spent 12k on last year). Getting back about a K. Not sure what else I can do to lower my tax risks. We file as single & 0. I look forward to the chunk of change as it supports my Bob Vila habits for the year haha.

Do you have 529 plans in CT? it might not offer you a tax break on the fed, but some states offer a credit, and it offers you a tax advantaged way to save/grow for your kids college

be careful about buying a 529 plan in another state as it may not offer you the same advantages, but this might be something worth looking into.

if you have a high deductible insurance plan be sure to max those HSA contributions also as a tax deferment

do you mean the w4 is set this way for withholding?We file as single & 0

have you a/b tested married filing jointly vs married filing separately?

Do you itemize?

write off your office space?

pretty much, but this assumes everything is the same.Maybe I just solved my own question...I just looked at my W4 information online and I see that after your allowances you can specify an additional amount that you'd like taken out of your paycheck. I'm guessing that's where I need to allocate additional funds. Next question then...knowing how much our refund dropped, is that the target amount I should shoot for when deciding how much to take from each paycheck depending on how many paychecks she gets a year?

For example if the number is $1,600 and she gets paid 12 times a year, I'd want an additional $133 taken out of each paycheck?

honestly, i'd tell her to claim 0 and you to move down 1 notch to cover her salary if you're not already at 0.

if you make 100k, each allowance is roughly $1200

so, do the math if you make less than that, you may need to claim 0 if you claim 2 now at 70k for example.

Or, you can make her pay it and have a measly check. lol

I was just informed that I need to fill out a 1096 form and roughly a dozen 1099-MISC forms for the Non-Profit that I was treasurer for up until December of this year. I ordered some from the IRS but I am getting nervous that I will not have them in time. I know that I can buy them from Office Depot/Max but would prefer not to spend money on them as I would have to buy way more than I need. Do you know where I can download/get a copy of these forms? I found a couple of places but they warn about being fined if the IRS can't scan them.

One last question. My forms are carbon copies (5 in a set) how many copies do I keep, how many do I send the person and how many do I sen the IRS?

O and the top of the 1099 misc is red ink (two forms to a page) do I need to fill it out twice for each person or is each half for a different person?

As a new homeowner, what, if any tax credits are out there for betterments/improvements to the home? We did not do much last year but will probably spend a significant amount ($50,000-$100,000) in bettering our property this year.