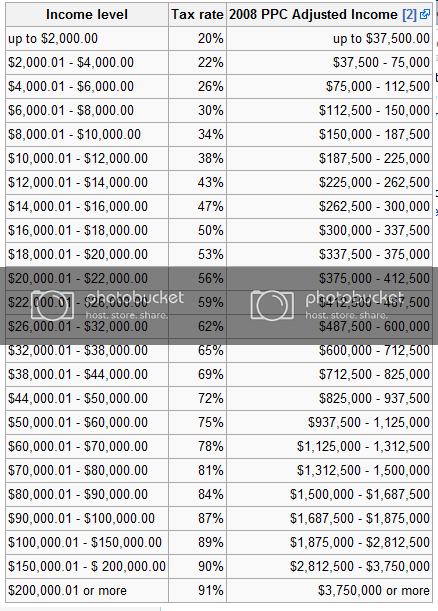

the tax rate only applies to the income in that bracket, and the income is generally based on adjusted gross, not gross per say.

so if you made $3000, $2000 would be taxed at 20%, and $1000 would be taxed at 22%

if you made over $200k, only the income over $200k is taxed at 91%, and everything below is taxed according to its bracket

this is known as a progressive tax, aka tax bracket system or ladder tax, as oppossed to say a flat tax where everyone would pay the same percentage of their money.

i would consider a flat tax to be the most fair by the basic principle of the word, you make $10 or $10k you still pay 10%, but then everyone bitches because the $1 for someone who makes $10 is considered a heavier burden than $1000 for someone who makes 10k, because the person who made 10 only has 9 left, while the person who made 10k, still has $9000 left.

today if you made $3000, paid in no federal tax, and had a kid, you'd probably get back about $7000 of money (from people that pay taxes... just sayin)

if you get back more of a refund, than you even paid in.... there is something wrong