I was reading an article about retirement and making your money last.

The article recommended a website to take an age survey.

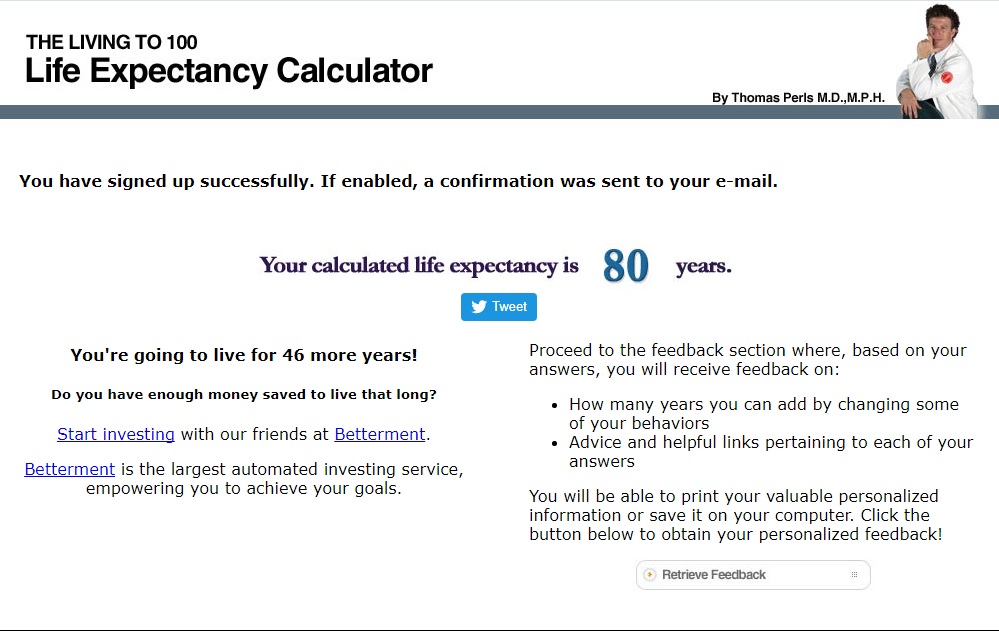

https://www.livingto100.com/calculator

You will need to enter email and password to get results.

It takes about 10 minutes but the results came back saying I will live to 91.

Looks like I need to plan for a little more savings than I originally anticipated before I retire.

The article recommended a website to take an age survey.

https://www.livingto100.com/calculator

You will need to enter email and password to get results.

It takes about 10 minutes but the results came back saying I will live to 91.

Looks like I need to plan for a little more savings than I originally anticipated before I retire.

Last edited: