my lifetime position isn't great for a couple reasons.

1) when i first started out 3 years ago, i had no idea what i was doing and no one to guide me. As a result, i made a LOT of stupid choices that there's little point to selling for pennies on the dollar at this point. Might as well just sit on it and see what happens. But with my bad choices, i learned a ton along the way. So, i chalk that up to my 'education expense'

You don't have to go through the same thing i did... there's people there to help you now.

2) I've been buying like crazy, well knowing that some of them were still headed down. With these, i don't care about 2009 results at all. 2009 is a buy at dirt year for me for my longs.

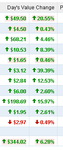

All that said, i'm only down 18%. But the market is down like 30%. so, i beat the market by 12%. If you factor out my stupid n00b choices, its something closer to 10%.

and finally, if you factor out my buy and longs, i'm up... a lot.

40% 'er

IMPM.PK: Summary for IMPAC MTG HLDGS INC - Yahoo! Finance

This is one of my noob bad choices. Formerly known as IMH. then dropped to pinks when housing collapsed. i lost nearly $900 on them. the 40% gain is a joke. i need to see 4000% to break even.

my 24% choice is ambak

ABK: Summary for AMBAC FINL GRP INC - Yahoo! Finance

This is one of my buy and hold long's. this stock was nearly $100 before the housing crash. I buy as much as I can every month while its dirt cheap. Financials are good again, and its been headed up the past 6 days or so. I fully epect to see this back in the double digits in a few years once the markets turn around. buy now while its cheap. I'm still dollar averaging down on this from some low $1.xx buys. So, yes, i am down on it, but when it goes back, and it will, i'll have a ton of shares at cheap prices for the most gain.

my 10% one is sirious

SIRI: Summary for Sirius XM Radio Inc. - Yahoo! Finance

as previously discussed.